I did not want to do a budgeting activity with my Activity Day girls because I thought it would be sooo boring. But I also recognized that poor money management is a major issue these days, and that I should try to teach it because it’s important. I came up with this “game” of sorts to get the girls thinking about budgeting. They loved it! In fact, two of them asked me to email a copy of the activity to their parents so they could play again at home!! And great news for you – I’ve done all the planning for you, so all you have to do in advance is print the documents with a color printer and gather some scissors!

Duration: 1 session

Supplies:

- Printed documents: Budget Money and Budget Items

- Scissors for each girl

- (Optional but recommended) Envelope for each girl

Preparation:

- Print BOTH documents: Budget Money and Budget Items

- If you have more than ten girls, you can print out each career more than once, add more careers into the mix, or have them work in teams.

- The prices in “Budget Items” reflect costs of living in Tucson, AZ. If you live in an area that has a significantly higher cost of living, such as Los Angeles, you might consider creating your own.

Activity:

- Start by asking the girls what they know about budgeting and why it’s important. Answer any questions they might have.

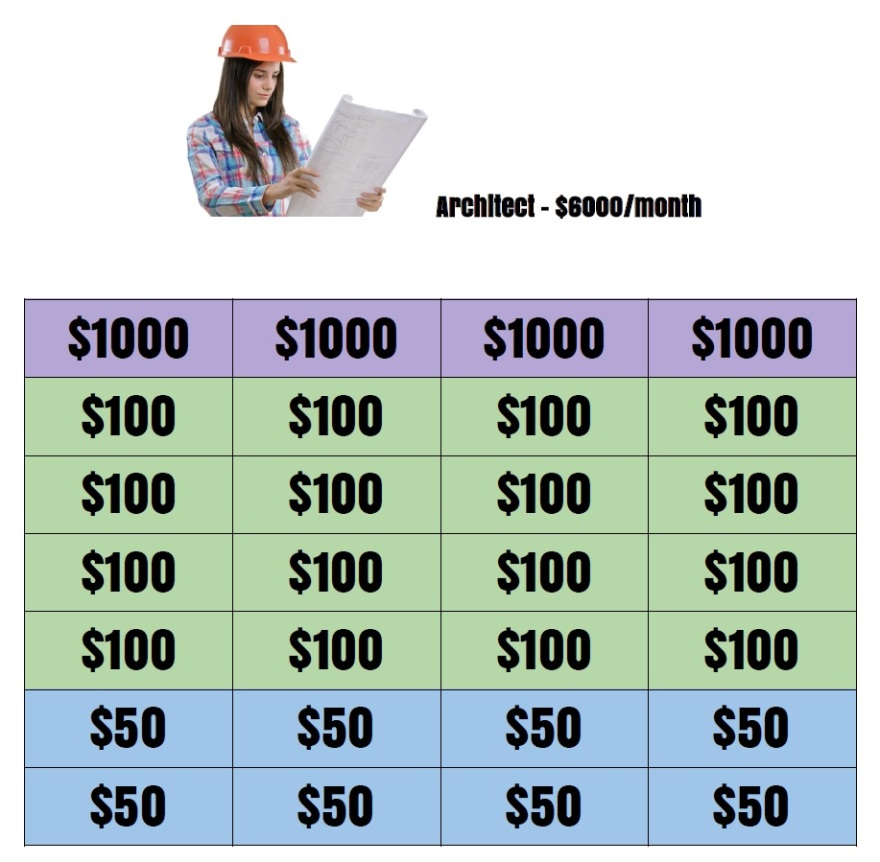

- Explain to them that we are going to play a game where each of them pretend they are in a family of four where just one of the adults works. They will each get a paper with their career and one month’s salary on it. They need to cut off the top with their picture/career, and then cut apart the “money.” (Each rectangle is a “bill” with the dollar amount on it.) (If you want to save fifteen minutes of time you can skip the cutting out part and have each girl cross out the money as they go. Not quite as fun, but still works great.)

- Once all the money is cut out and arranged in front of each girl, have each girl share the career and the monthly salary they get. (I used this time to point out that, in general, the more education or experience required for a job, the higher the salary.)

- Start going through the Budget Items as follows:

- Tithing: We have some girls who are not members of the Church who attend with us, so I took the time to explain tithing to them. Some did not choose to pay tithing and I did not make it compulsory for them. Helping to calculate 10% can be difficult, so give them the tip that if they just cover up the last zero in their monthly salary (listed next to the picture of their career), that is the amount of tithing they need to pay. Have each girl place their tithing in their envelope (each time they “spend” money during this activity, have them put it in their envelope).

- Taxes: This was the hardest one for them to figure out. They need to pay twice as much as whatever tithing they paid.

- Housing: They get to choose which type of housing they want. I briefly explained the pros and cons of each choice. (These costs include utilities just to make the activity a little easier.)

- Food: These are just general examples of the type of food they might get with that budget, and so I let them choose in between two numbers if they wanted to. For instance, if they want to have the “Average American Food Budget” but want to eat out a little more often than the average family, they could choose to pay $800 a month instead of $700.

- Transportation: They get to choose which type of transportation they want. I briefly explained the pros and cons of each choice. I let one girl be flexible with this one – she chose $150/month because she wanted to own an old car for emergencies but walk most of the time. Since this is a valid and creative choice I let her do it. (Keep in mind that some LDS families believe that people should not go into debt with car payments. So I made it clear that they could think of these costs per month as saving up for the next car, rather than payments on a current car.)

- Clothing: Again, these are examples of what they might get for their money so I let them choose “in between” numbers if they wanted to.

- Savings and Debt: My girls didn’t know what debt was so I explained different types of debt, and why you might have to go into debt. I think there is a danger in painting all types of debt as bad – the doctor might have school loans, for instance – but told them that we should avoid debt whenever possible. Then explain that experts recommend that 20% of your budget should go towards paying off debts, or if you have no debt, then that 20% should go into savings. (Ask them to share a variety of reasons why saving is important.) Have them decide how much of their money they can put towards debt or savings and put it ON TOP of the envelope. (Some may not have any money left at this point.)

- Before showing them the last Budget Item, ask each girl to count the money they have left.

- What Else? Use the paper to generate some ideas about what other things they might spend money on. Do they want a pet? Does their daughter want to be on the soccer team, or their son in ballet? Are they a movie buff? All of these things cost money! This category is too complicated to really go through all of the expenses, but I did point out the pet one (girls this age love fluffy animals), and gave them the general cost of seeing a movie as a family, paying for a hotel room on a trip, cost of a birthday present, cost of summer camp, etc., to give them an idea of how much these “extras” cost their family.

- After the exercise is done, I went around the room and had each girl remind the group what career/salary they had, and then tell us their choices for housing, food, transportation, and clothing (I showed them the Budget Items one by one to jog their memory). Then they shared how much they were able to save (it should be on top of their envelope) and how much spending money they had left over. I gave some praise to those who made wise spending choices, and for those who were a little too frivolous, asked them what they could have done differently. (At this point one girl commented that she thinks it would be better if both parents worked so you could get more money. I reassured her that many families do this, and that’s fine, but that two salaries doesn’t always mean more money. Expenses like house cleaning, child care, and eating out more might crop up more often in a home where two parents work. So, it’s something that couples should work together to figure out.)

- At this point, we had chatted so much that we only had five minutes left and ended the activity. But if you still have at least ten minutes left, I would have each girl switch careers with another girl and do the exercise again. It should be much faster but a great reinforcement on making wise budget choices.

Quotes You Might Use:

“Let us become better managers of our economic resources. The first step could be to plan a workable budget. This should be one that is uniquely right for us. Our budget, in addition to allowing for the basic payments to the butcher, the baker, and the mortgage loan banker, should include a payment to ourselves—in the form of savings, even though it may be meager at first.”

Barbara B. Smith, Relief Society General President

“Follow Joyously,” October 1980 General Conference

“…Life is made up of small daily acts. Savings in food budgets come by pennies, not only by dollars. Clothing budgets are cut by mending—stitch by stitch, seam by seam. Houses are kept in good repair nail by nail. Provident homes come not by decree or by broad brushstroke. Provident homes come from small acts performed well day after day. When we see in our minds the great vision, then we discipline ourselves by steady, small steps that make it happen. It is important to realize this correlation between the large and the small.”

Barbara B. Smith, Relief Society General President

“Follow Joyously,” October 1980 General Conference

“Covenants save us from needless suffering. For example, when we obey the prophet’s guidance, we are keeping a covenant. He has counseled us to avoid debt, maintain a food supply, and become self-reliant. Living within our means blesses us beyond that obedience. It teaches us gratitude, restraint, unselfishness; it brings peace from financial pressures and protection from materialism’s greed. Keeping our lamps filled means that unforeseen circumstances do not hinder opportunities to declare with devotion, ‘Here am I; send me.’ ”

Bonnie D. Parkin, Relief Society General President

“With Holiness of Heart,” October 2002 General Conference

I used your plan last night. It was great! I didn’t have time to read everything because the girls were very talkative. I’ve saved a copy to teach our family FHE or whatever i may need for the future. I love this web site. I’m sorry to hear the Web site creator is finished creating Activity Day ideas. I really do love this site and all the different ideas. I’ve used them to teach my Girl Scouts, FHE, and church youth. THANK YOU : ) Kristn

LikeLike

Thanks, Kristn! I do hope that others will contribute to the site – I would love to post their ideas. I’m glad you are able to use the ideas for so many things!

LikeLike

Love this lesson idea! I think the girls will love it, too.

LikeLike

Thank you so much for this! This is exactly what I wanted to do for our activity, but didn’t quite know how to put it together. So thank you for doing the hard work for me! I love the game of life, and this mimics it nicely which is what I wanted to do. 😁

LikeLike